Q1 CRE Chartbook: Property Prices Growing Fastest Outside the Gateway Markets

The U.S. economy grew faster than expected in the first quarter, with real GDP rising at a 2.2 percent annual rate. Moreover, the quarter ended on a strong note and growth appears to have

ramped up considerably in Q2. Nonfarm employment has risen by an average of 207,000 jobs per month so far this year, up from an average of 184,000 jobs per month last year, while the

unemployment rate has fallen to 3.8 percent. Wages and salaries are still rising only modestly compared with other periods when labor market measures were this tight. Inflation has also moved

back to the Fed’s 2 percent target range and may actually run a little above that range. We expect the Fed to continue to gradually nudge short-term interest rates higher.

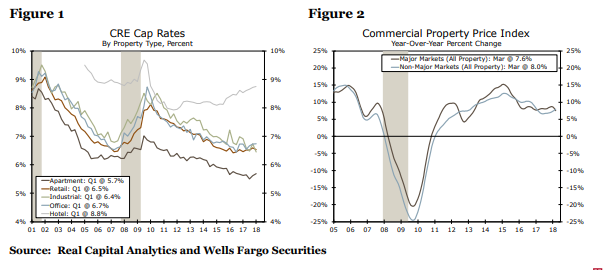

A common concern among real estate investors is the potential adverse impact rising interest rates may have on property values. Cap rates have risen for two consecutive quarters and appear to be

moving up alongside the 10-year Treasury yield. According to Real Capital Analytics, cap rates rose 25 basis points in Q1, the largest quarterly increase since 2009. Despite the increase, cap rates

remain below their prior cycle lows. Rising interest rates also come amidst an increasingly solid economic backdrop that is driving demand for commercial real estate. We anticipate the rise in cap

rates should be minimal and largely offset by rising occupancy and higher rents.

Property prices are currently at all-time highs. The Commercial Property Price Index has risen 8.5 percent over the past year and is 23 percent higher than its pre-recession peak. Prices increased

across all property types, but especially for apartments and industrial buildings. Since the end of 2017, price appreciation in major gateway markets has moderated somewhat, while secondary

markets have seen prices rise more rapidly. This comes as no surprise, as many secondary markets are attracting a great deal of investor interest given their stronger population and employment

growth, particularly relative to major gateway markets.

Click to read more at www08.wellsfargomedia.com

Back to rednews.com